This guarantee is good for the lifetime of your personal, individual tax return, which Intuit defines as seven years from the date you filed it with TurboTax. 100% Accurate Calculations Guarantee – Individual Returns: If you pay an IRS or state penalty or interest because of a TurboTax calculation error, we'll pay you the penalty and interest.Mac CD/Download Products (Basic, Deluxe, Premier, and Home & Business)

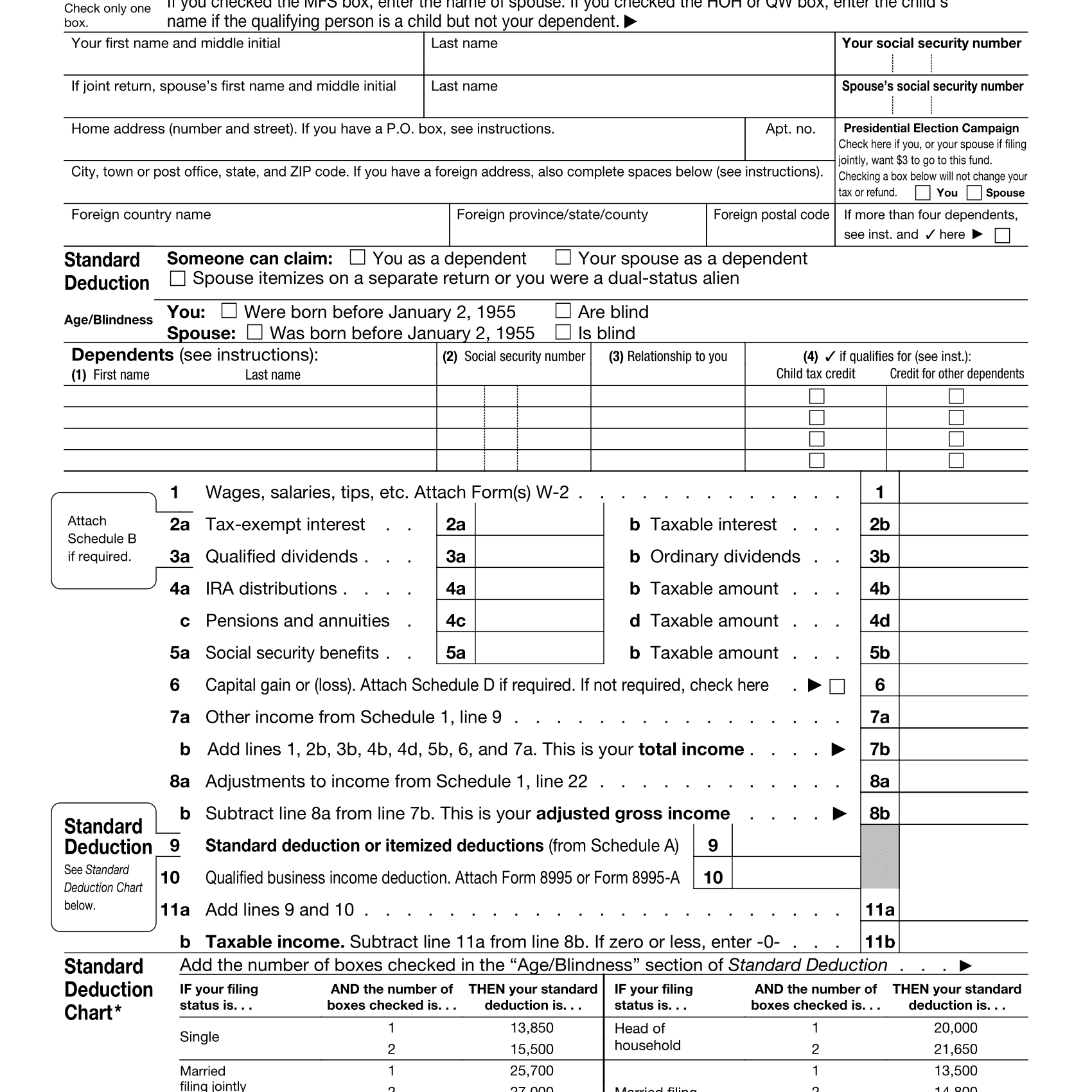

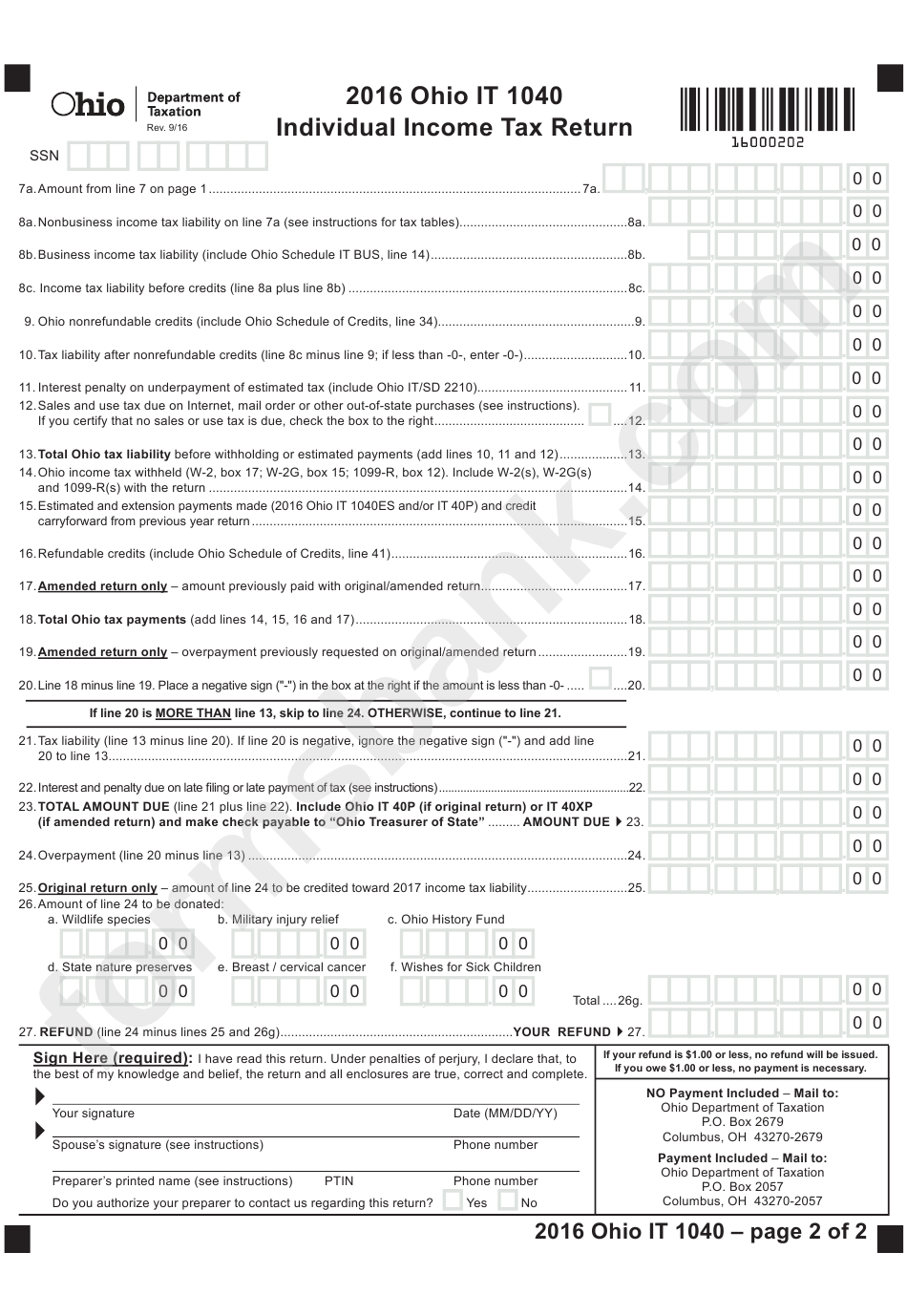

Any Windows-compatible inkjet or laser printer.Required for product activation, software updates and 1 Mbps modem (Broadband connection highly recommended).NET 4.8 (included with TurboTax Installer) 1 GB for TurboTax (plus up to 4.5 GB for Microsoft.Specific Windows OS: Windows 10, Windows 11 Windows 10 or later (Windows 8.1 not supported).Product activation requires internet connectivity.Īnd Business) NOTE: TurboTax Business is Windows Only Operating Systems " Publication 929 (2021), Tax Rules for Children and Dependents."Download option requires a free online Intuit account. " About Schedule 8812 (Form 1040), Credits for Qualifying Children and Other Dependents." " About Schedule SE (Form 1040), Self-Employment Tax." " About Schedule R (Form 1040), Credit for the Elderly or the Disabled." " About Schedule J (Form 1040), Income Averaging for Farmers and Fisherman." " About Schedule H (Form 1040), Household Employment Taxes." " About Schedule F (Form 1040), Profit or Loss From Farming." " About Schedule EIC (Form 1040 or 1040-SR), Earned Income Credit." " About Schedule E (Form 1040), Supplemental Income and Loss." " About Schedule D (Form 1040), Capital Gains and Losses." " About Schedule C-EZ (Form 1040), Net Profit From Business (Sole Proprietorship)." " About Schedule C (Form 1040), Profit or Loss From Business (Sole Proprietorship)." " About Schedule B (Form 1040), Interest and Ordinary Dividends." Self-Employment Tax Return (Including the Additional Child Tax Credit for Bona Fide Residents of Puerto Rico)." " Agency Information Collection Activities Submission for OMB Review Comment Request U.S. " Tax Reform Affects if and How Taxpayers Itemize Their Deductions."įederal Register.

0 kommentar(er)

0 kommentar(er)